osceola county property tax payment

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report. Please contact the Collector office at 704 920-2119 to get your plan for payments.

Osceola County Fl Property Search Interactive Gis Map

Osceola County collects on.

. Search Use the search critera below to begin searching for your record. Use Advanced Address Search. Search all services we offer.

14 the total of estimate taxes discounted 6. You can also make full or. If you are unable to pay your tax in full then you can make partial payments.

Taxpayers can call Personal Teller at 877-495-2729. You can talk to a live agent to pay with eCheck credit or debit card. Discover Mastercard Visa and e-Check are accepted for Internet Transactions.

Search and Pay Property Tax. Motor Vehicle Titles and Registrations. Renew Vehicle Registration Search and Pay Property Tax Search.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report. The following payment schedule applies to the installment plan. Search Use the search critera below to begin searching for your record.

All personal property taxes are payable to the Village of Osceola and due by January 31st of each year. New Drivers Licenses Renewals. OSCEOLA COUNTY TAX COLLECTOR.

Irlo Bronson Memorial Hwy. Osceola County Tax Collector. Renew Vehicle Registration Search and Pay Property Tax Search.

The County Treasurer is. Issues Tests for Motor Vehicle Operation. Search all services we offer.

Apportions taxes to Various Entities. OSCEOLA COUNTY TAX COLLECTOR. Payment due by June 30th.

Yearly median tax in Osceola County. 407 742-4000 407 742Fax. Irlo Bronson Memorial Hwy.

As part of our commitment to provide citizens with efficient convenient service the. Tax Online Payment Service. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

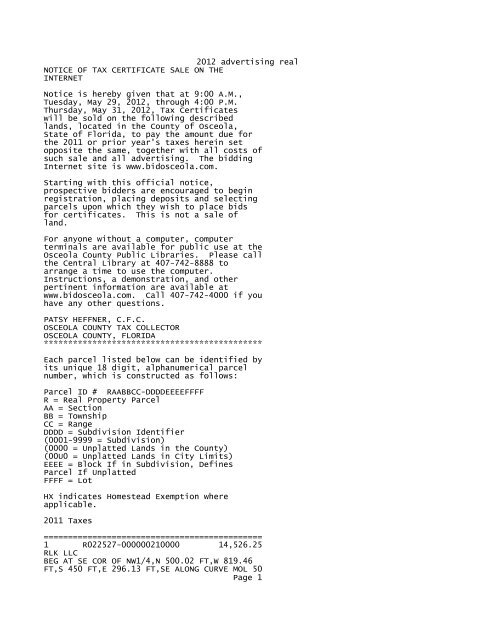

Delinquent Tax Online Payment Service. Box 422105 Kissimmee FL 34742-2105. Collects Property Tax Payments.

When paying property taxes by parcel number please enter the 10 digit parcel number which. Summer 2022 Property Tax Information. Reed City MI 49677.

Search and Pay Property Tax. We are doing some maintenance on our website to improve your experience.

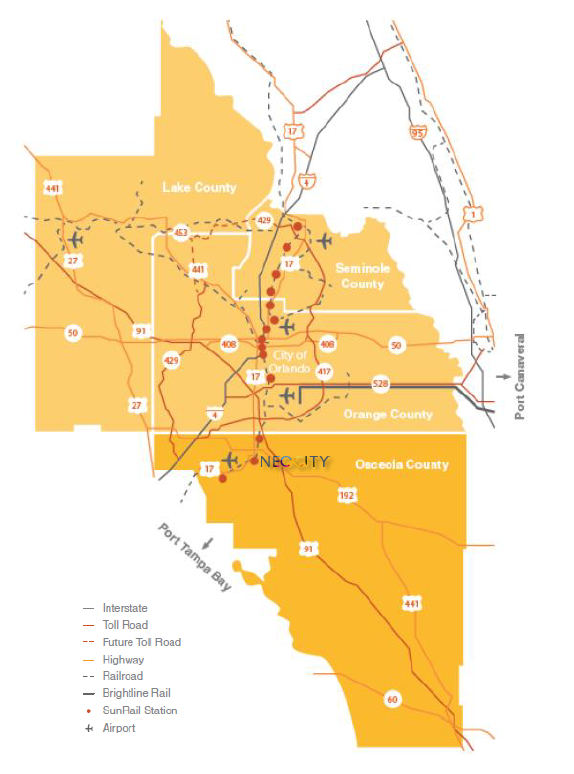

Use Your Resources Lake Nona Regional Chamber Of Commerce

Faqfriday Faq I Can T Pay My Property Taxes Can I Sign Up Now For The Installment Plan Answer No To Participate In The Installment Plan For By Osceola County Tax Collector S

Real Estate And Tax Data Search Fond Du Lac County

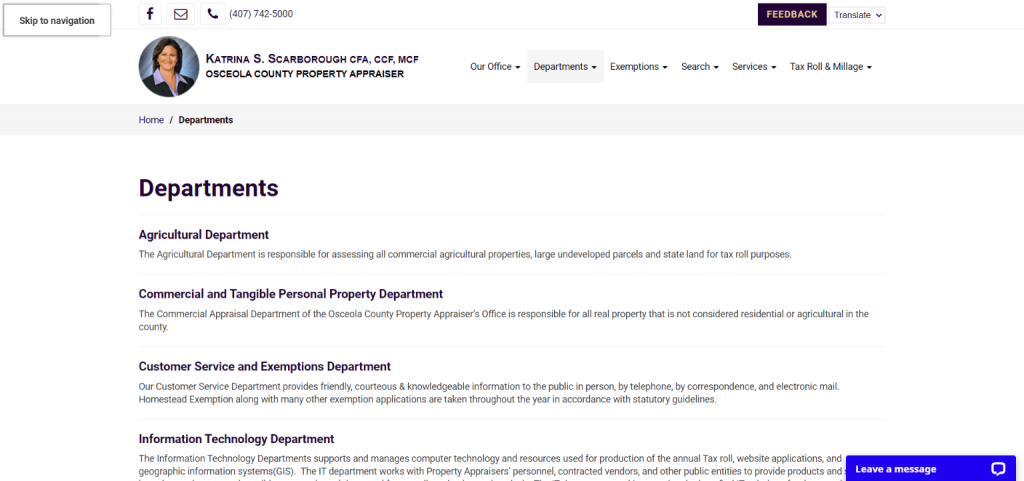

Appealing Your Value Osceola County Florida

Patsy Heffner Cfc Osceola County Tax Collector

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Economic Opportunities Osceola Neocity

Osceola County Short Term Rental License Fill Online Printable Fillable Blank Pdffiller

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Annexations City Of St Cloud Florida Official Website

Osceola County Fl Locate The Documents Tax Deed Auctions And Excess Proceeds Youtube

Registrations Taxsys Osceola County Tax Collector